Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 22 July

Unemployment rate in OECD nations stood at 6.6% in May 2021, marginally down from 6.7% in April 2021. The unemployment rate among G7 nations also decreased to 5.5% in May 2021 from 5.7% in April 2021.

The total number of Covid-19 vaccine doses administered has surpassed the total confirmed cases of Covid-19. So far, more than 2.9 billion single doses of Covid-19 vaccine have been administered.

6.1%

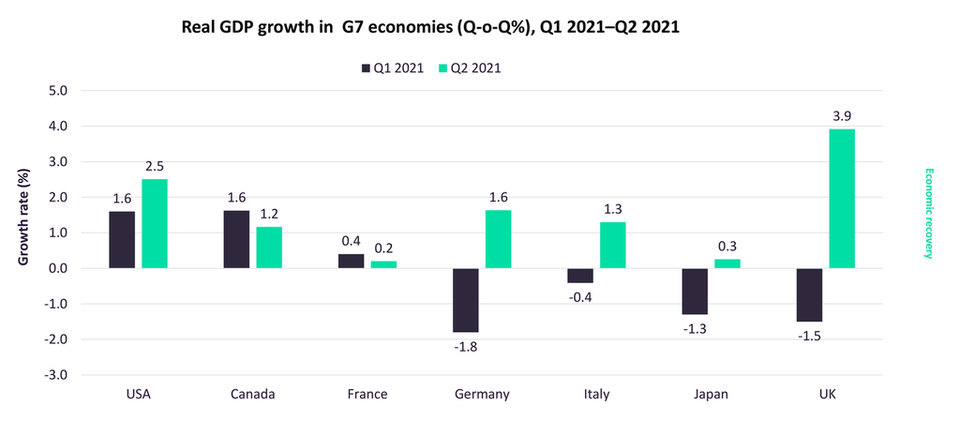

After several months of downturn, positive GDP growth is forecast in all countries and 2021 consensus forecast for GDP growth is 6.1%.

181 million

Covid-19 has now spread to 198 countries, with more than 181 million confirmed cases and more than 3.9 million deaths recorded.

- SECTOR IMPACT: CONSTRUCTION

Latest update: 7 July

Despite the huge stimulus packages, sharp cuts in interest rates and other unprecedented policy measures across all major markets, the construction industry is likely to be subdued beyond the immediate period of lockdowns and other containment measures.

Generally, the construction industry will be heavily affected by the expected widespread disruption to economic activity and a likely drop in investment, which could lead to planned projects being delayed or cancelled.

Commercial: significant negative impact

Commercial construction is likely to be the hardest hit in 2020, with sectors such as retail, leisure and hospitality already suffering from the decline in trade, travel and consumer and business confidence.

Residential: significant negative impact

The residential sector will struggle as unemployment rises, despite low interest rates and direct government support. There is a high risk that a considerable proportion of early-stage projects in the sector will be cancelled or delayed.

Industrial: significant negative impact

The industrial construction sector is most at risk from the severe drop in economic activity. Immediate priorities for manufacturers will be to stay afloat and rebuild core operations, rather than invest in new premises or capacity.

Energy & utilities: moderate negative impact

Spending on energy and utility projects will be severely impacted by global supply chain disruptions and low oil prices. However, governments and public authorities will likely advance spending on power and utilities projects as soon as normality returns.

Institutional: significant positive impact

Governments are strengthening their healthcare infrastructure and the number of new hospital projects is rising sharply. This investment is helping to support the institutional building sector.

Infrastructure: moderate negative impact

Infrastructure projects will be a priority for government investment as soon as normality returns. With interest rates at record lows, borrowing costs will be at a minimum, but success will depend in part on the financial standing of governments post-Covid-19.