Comment

Supply chain and material prices pose risks for construction

While economic activity in the construction industry has increased, Europe is facing supply chain difficulties and rising prices for raw materials, according to GlobalData.

Following the gradual reopening across Europe in response to falling infection rates and successful vaccine rollouts, economic activity for industries such as manufacturing and construction has picked up in recent months.

Despite lockdown measures still not being fully lifted, consumers have begun spending again following the reopening of non-essential businesses. Activity in sectors such as manufacturing and construction has picked up significantly following a difficult year, which saw major disruptions in activity due to the lockdown measures imposed by governments across the region.

The sharp rise in activity across all sectors of the economy due to pent up demand has led to supply-side issues arising, with materials such as plastics, cement, timber and lumber all in shortage due to excess demand and supply chain difficulties.

This is reflected in the latest inflation data release from the European Central Bank, which showed that inflation in the Eurozone reached its highest level in three years. In the UK, there was a similar theme, with the Office for National Statistics reporting that the annual inflation rate doubled in April increasing to 1.5%.

While most economists agree that price pressures are largely driven by base effects and the reopening of economies following lockdowns in 2020 and at the start of the year, the upsurge in the price of raw materials and other commodities will have some near-term implications for the wider economy and the construction industry in particular.

New Clark City is a smart city in development in the Philippines. Credit: Broadway Malyan

Shortages and delays

Construction activity has significantly picked up since the start of the year, with firms feeling more certainty and optimism regarding the outlook for the economy. There has also been a surge in home renovation projects.

However, this sharp rise in demand in the sector is compounding price pressures that had begun to build up due to shortages in the supply of construction materials caused by Covid-19 disruptions. The ONS has forecasted an 8% increase in material prices over the next year.

In May, the Federation of Master Builders reported that contractors in the UK may have to delay projects because of material shortages to avoid cost overruns.

Meanwhile, the European Plastics Converters has also reported that raw material shortages are being felt across Europe, citing the delayed shipment of products and many producers in Europe being forced to suspend operations as a result of the pandemic as the main factors behind the shortage.

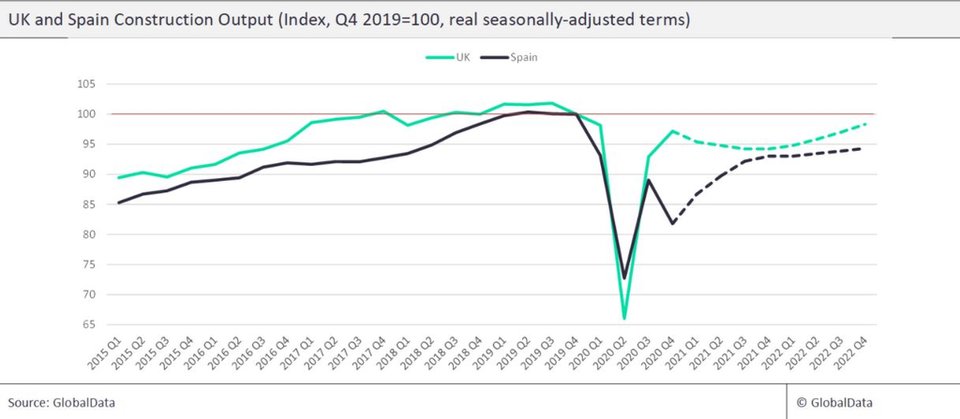

The outlook for the European construction industry remains strong for 2021, despite the downside risks coming as a result of increasing prices across the region. In Western Europe, construction output contracted by 6.6% in 2020 but is expected to grow by 5% this year, supported by the reopening of the economy and policy stimulus from the regional authorities.

While in Eastern Europe output is expected to grow by 3.6% in 2021. A major downside risk for the economy and industry is the emergence of new virus variants that could evade vaccine protection and potentially force regional governments into imposing further lockdowns or restrictions on economic activity.

Having a piece of software that uses a non-proprietary-based data exchange means the files can be easily shared.

Main image: Construction workers return to work in Barcelona, April 2020. Credit: Daniel Ferrer Paez | Shutterstock.com