Comment

Tech spending in construction set to rise

The construction industry is expected to increase its spending on technology as activity picks up again after the Covid-19 challenges, according to GlobalData.

While companies in other industries are often part of a continual race to innovate in tech faster than their competitors, attitudes in the construction industry are often thought to reflect a desire to maintain the status quo, provided existing processes are considered satisfactory by clients and management.

Among the challenges for companies in the construction industry when it comes to investing in new technology is that they find there are limited financial gains in the short term; it is difficult to justify making financial commitments when operating margins are tight.

This challenge has become even more acute amid the Covid-19 pandemic, which has resulted in a severe downturn in construction activity globally.

However, following a difficult year for contractors in 2020, there are signs of growing optimism in the industry with the pick-up in global economic activity and this is expected to support an upturn in investment.

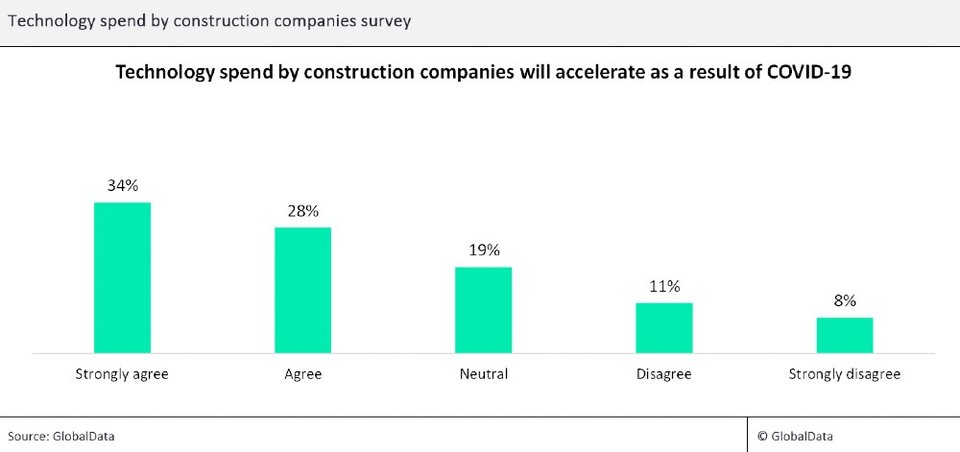

This is reflected in GlobalData’s latest Covid-19 industry survey, in which 34% of construction companies responded that they strongly agreed that technology spending will increase as a result of Covid-19. While a further 28% agreed, only 19% of respondents disagreed or strongly disagreed and the remaining 19% were neutral.

Open BIM enables more informed collaboration, resulting in better quality builds. Credit (all images): Reid Brewin Architectes

Remote working in construction

With a large backlog of projects in the pipeline coupled with labour and raw materials shortages that have led to price pressures, companies are likely to be looking to increase spending on technology to deal with the near-term fallout from the pandemic and to also position themselves to deal with any future challenges.

The industry has been making use of construction-specific technologies such as building information modelling and 3D printing. Drones, or unmanned aerial vehicles, have also become increasingly popular in the construction industry.

The industry is now reported to be one of the largest drivers of growth in the commercial drone sector. There are a number of potential uses for drones within construction, such as the ability to survey projects through the use of drones in comparison to more traditional means of surveying.

While the uptake of artificial intelligence (AI) technologies has been slow, AI has the potential to deliver tangible benefits at every step of the construction value chain, from conceptual design to operations and maintenance.

The use of digital twins, which are digital representations of physical assets and systems to help detect, prevent, predict and optimise the physical environment through the use of AI, has also become more prevalent.

In the construction sector, digital twins are being used to make investment decisions based on actionable data such as assessing the performance of buildings in real time and adjusting performance to optimise efficiency.

GlobalData predicts that construction companies will spend $1bn on AI platforms by 2024. This is up from $436m in 2019, representing a compound annual growth rate of 19.2% between 2019 and 2024.

Having a piece of software that uses a non-proprietary-based data exchange means the files can be easily shared.

Main image: London’s Soho neighbourhood. Still from the short film Queering Public Spaces.