Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 22 November

According to the OECD, the unemployment rate in OECD nations stood at 5.8% in September 2021, down from 6% in August 2021. The unemployment rate among G7 nations declined from 5.1% in August 2021 to 4.9% in September 2021.

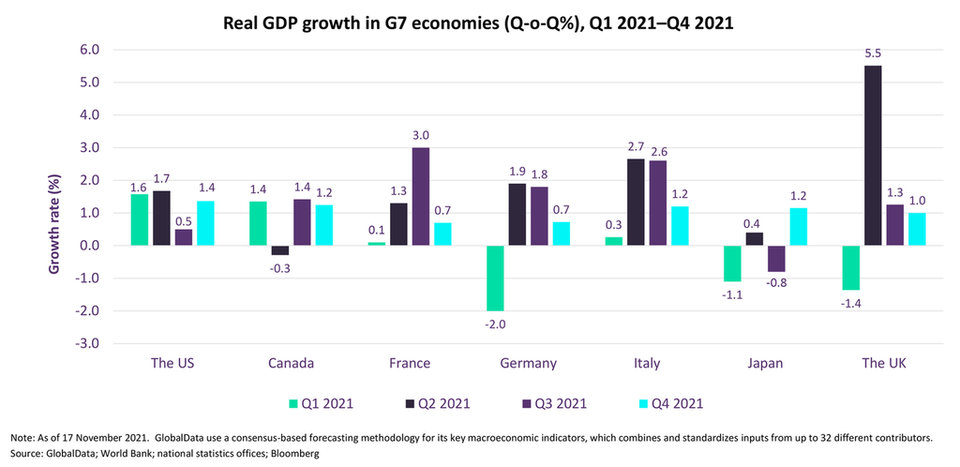

Real GDP in the UK expanded by 1.3% during July September 2021 a slowdown from 5.5% growth recorded in the previous quarter. Monthly GDP rose by 0.6% in September 2021 as compared to 0.2% growth recorded in August 2021.

4.9%

China’s real GDP growth rate slowed down to 4.9% (YoY) in Q 3 2021 as compared to 7.9% growth recorded in the previous quarter, according to the National Bureau of Statistics.

1.3%

Real GDP in the UK expanded by 1.3.% during July-September 2021 a slowdown from the 5.5% growth recorded in the previous quarter.

- SECTOR IMPACT: CONSTRUCTION

Latest update: 3 November

Supported by stimulus packages, low interest rates, and other unprecedented policy measures across all major markets, the construction industry is recovering from the severe disruption caused by Covid-19 lockdowns and other containment measures.

The infrastructure and residential sectors have been picking up quickly, but the commercial and industrial construction sectors have suffered from a drop in investment, with planned projects being delayed or cancelled.

Commercial: significant negative impact

The leisure and hospitality sector will take time to recover from the devastation caused by the demise of the travel and tourism industry, and although plans for new retail buildings and office space might not have been completely derailed, changes in consumer behaviour and remote working practices could result in a re-examination of planned projects.

Residential: significant negative impact

Investment in the residential sector has recovered quickly, and global residential construction is projected to expand by 7.4% in 2021, a sharp rebound following the 2.8% drop in 2020. The sector continues to be buoyed by government support measures and housebuilding programs aimed to narrowing housing supply deficits in many markets.

Industrial: significant negative impact

Industrial construction is recovering from the Covid-19 induced downturn in 2020. Suring global demand for manufactured products will provide scope for renewed investment growth in manufacturing plants to improve capacity. Although global supply chain disruptions are likely to dampen confidence in the short term among manufacturers, the expansion in ‘nearshoring’ is likely to support investment in new facilities in various sectors.

Energy & utilities: moderate negative impact

Spending on energy and utility projects was impacted by global supply chain disruptions and low oil prices. However, governments and public authorities will likely advance spending on power and utilities projects, and the recovery in oil prices will provide support.

Institutional: significant positive impact

Governments across the world are preparing to fight the virus outbreak by strengthening their healthcare infrastructure, and building of new hospitals is rising sharply. This investment is helping to support the expansion in institutional buildings.

Infrastructure: moderate negative impact

Output in infrastructure was subject to relatively short-lived downturn in 2020 given the efforts by governments and public institutions to accelerate investment in infrastructure to stimulate activity. However, their successes will depend greatly on their capacity to continue to fund such schemes while dealing with the hit to their fiscal positions from the economic downturn and support packages for households and private businesses.