Comment

Understanding perceptions and opinions on ESG in construction

GlobalData's ESG survey in construction explores current opinions in the industry on environmental, social and governance factors.

GlobalData recently completed a survey of environmental, social and governance (ESG) issues in construction in order to understand current perceptions and opinions on what is the most important theme of the decade.

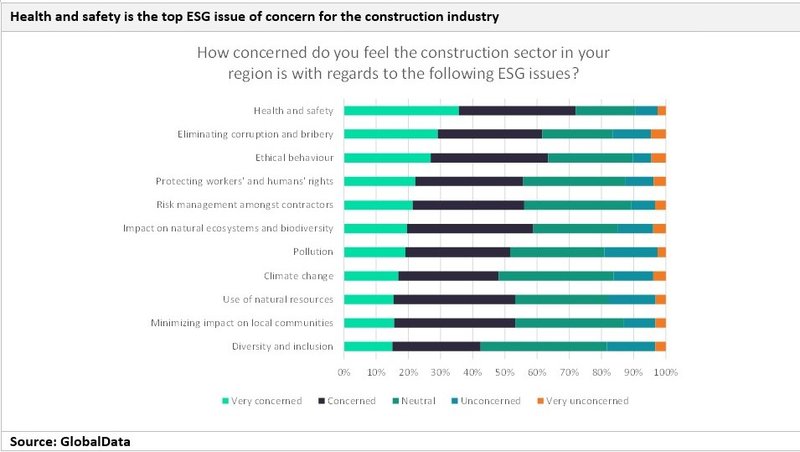

Participants in the survey were asked how concerned they felt the construction sector in their region is regarding certain ESG issues. Participants could choose from five options ranging from ‘very concerned’ to ‘very unconcerned’.

Based on the results of the survey, ‘health and safety’ is the most significant ESG issue of concern, with 72% of respondents saying that the construction sector in their region was either concerned or very concerned about this issue. Some 63% of respondents said that the construction industry is either concerned or very concerned with ethical behaviour, while 62% of respondents said the same about eliminating corruption and bribery.

Open BIM enables more informed collaboration, resulting in better quality builds. Credit (all images): Reid Brewin Architectes

Energy crisis impact on economic growth

Respondents were asked to identify the three biggest areas of focus for their business. Improving health and safety on the construction site is the top priority, with 51% of respondents selecting it as a focus for their company.

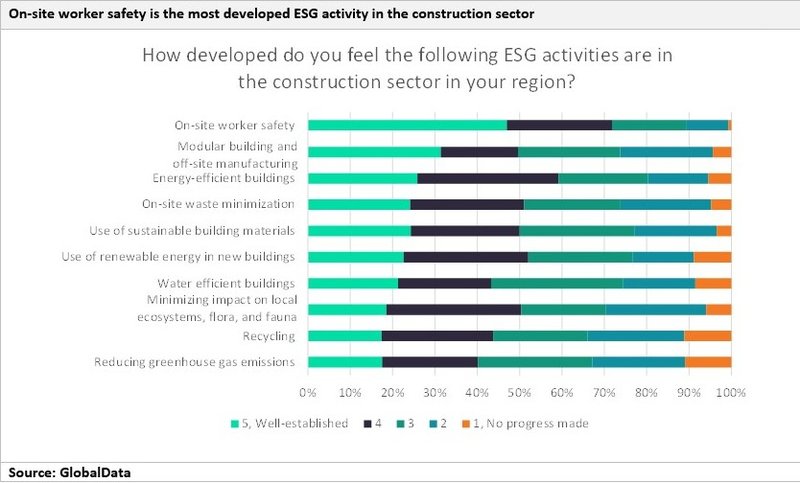

When asked how well-developed ESG activities were, 72% of respondents rated on-site worker safety as well-established. This suggests that even though worker safety has been a priority for some time, it remains as such for many companies. Improving risk management and protecting workers’ and humans’ rights is a focus for 36% of respondents.

Meanwhile, minimising the impact of construction activities on local communities is the focus for only 10%.

Having a piece of software that uses a non-proprietary-based data exchange means the files can be easily shared.

Respondents were asked how developed they feel certain ESG activities are in the construction sector in their geographical region. On-site worker safety is well-established according to 72% of respondents and is among the most developed ESG activity for all types of organisations, particularly for construction contractors and subcontractors.

In contrast, only 40% of respondents felt that reducing greenhouse gas (GHG) emissions is well-established in the construction sector.

Architects and designers feel that energy-efficient buildings and on-site worker safety are the most developed ESG issues in the construction sector. They also think that reducing GHGs is well-established in the industry. This may be because these companies have the greatest visibility of the design process and are therefore the most exposed to methods for reducing GHGs in built assets.

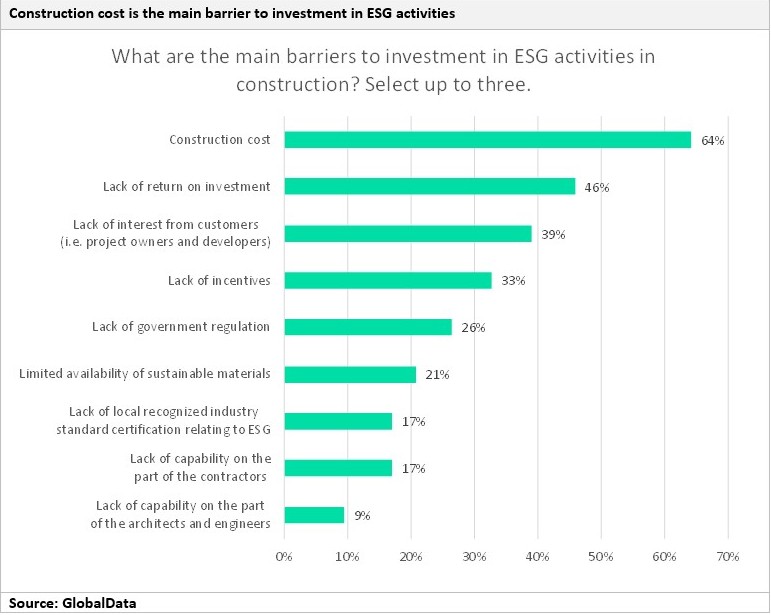

When asked about the main barriers to investing in ESG activities in construction, 64% of respondents said that the main barrier to investment was construction cost, and 46% cited a lack of return on investment.

The fewest respondents saw a lack of capability on the part of architects, engineers, and contractors as a barrier to investing in ESG activity. This suggests that investing in ESG-based construction is technically feasible but that there are few perceived financial advantages to investing in ESG activities in construction.

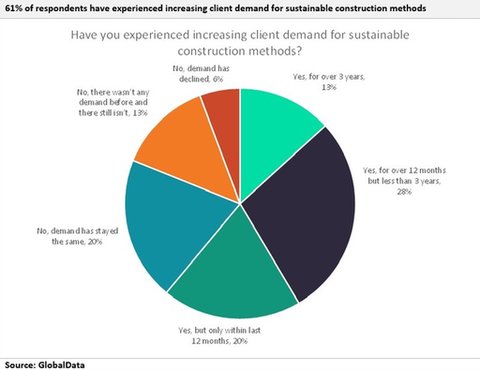

Respondents were asked if they had experienced client demand for environmentally sustainable construction methods. 13% said no, there wasn’t any demand before, and still isn’t. In contrast, 61% said they had experienced increasing client demand for sustainable construction methods.

The demand for sustainable construction seems to be broadly consistent across the construction sectors. Only about a fifth of respondents reported a very high demand for sustainable construction.

Main image credit: katjen | Shutterstock.com