DEALS ANALYSIS

Construction & real estate M&As down 52% on 12-month average

Powered by

Construction and real estate industry M&A deals total $6.01bn globally in February 2021

Total construction & real estate industry M&A deals worth $6.01bn were announced globally in February 2021, according to GlobalData’s deals database.

The value marked a decrease of 61% over the previous month, which recorded $15.41bn, and a drop of 52.1% when compared with the last 12-month average, which stood at $12.54bn.

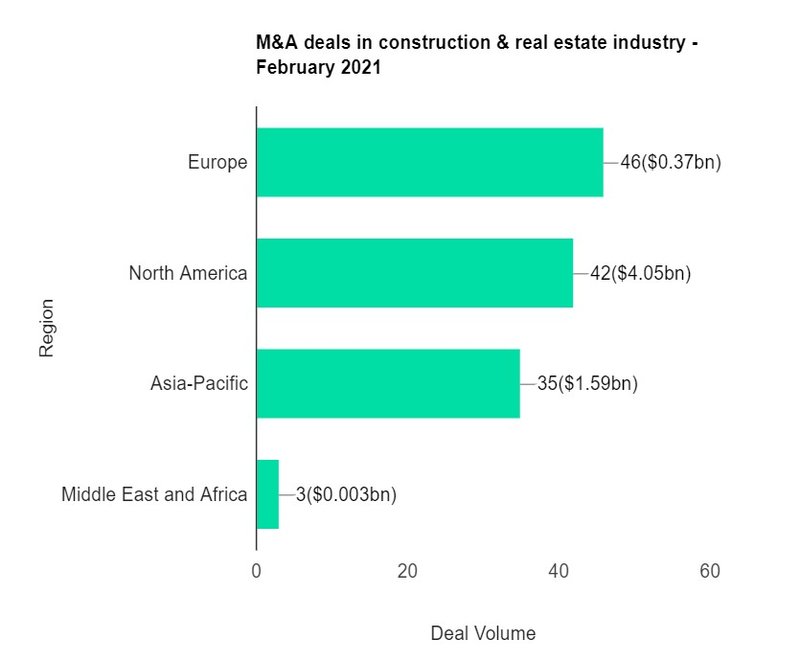

North America held the top position by deal value, with $4.05bn worth of deals announced in the period. In terms of deal volume, Europe was the top region, followed by North America and Asia-Pacific.

As of February, construction & real estate M&A deals worth $21.42bn were announced globally in 2021, marking an increase of 42.7% year on year.

Top five deals, as tracked by GlobalData:

- Quikrete Holdings’ $2.74bn acquisition of Forterra,

- The $989.76m acquisition of Shanghai Xinbao Enterprise Management by Caribbean Hero,

- Redfin’s $608m acquisition of RentPath,

- The $500m acquisition of ShowingTime.com by Zillow Group,

- FS Dongguan No. 6’s acquisition of Double Wealthy Ltd for $242.78m.

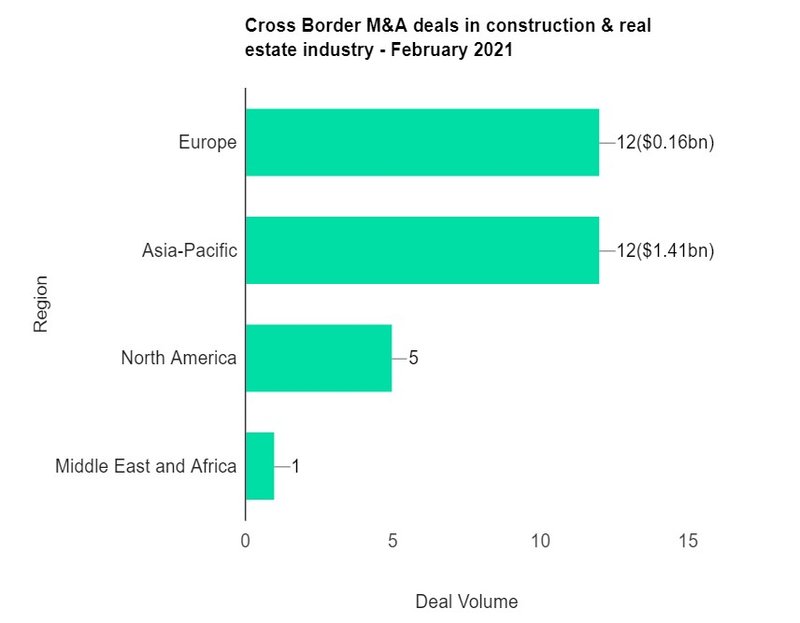

Cross border M&A deals total $1.57bn globally in February 2021

A total of $1.57bn cross border M&A deals were announced globally in February 2021, according to GlobalData’s deals database.

The value marked a decrease of 85% over the previous month of $10.44bn and a drop of 65.2% when compared with the last 12-month average, which stood at $4.51bn.

In 2021, as of February, construction & real estate cross border M&A deals worth $12.01bn were announced globally, marking an increase of 6.8% year on year.

Top five deals, as tracked by GlobalData:

- Caribbean Hero (HK)’s $989.76m acquisition of Shanghai Xinbao Enterprise Management,

- The $242.78m acquisition of Double WealthyLtd by FS Dongguan No. 6,

- City Developments’ $131.01m acquisition of Shenzhen Tusincere Technology Park Development,

- The $110.15m acquisition of Valmieras Stikla Skiedra by Duke,

- Endur’s acquisition of Marcon-Gruppen I Sverige for $47.62m.

Construction and real estate industry deals activity by region

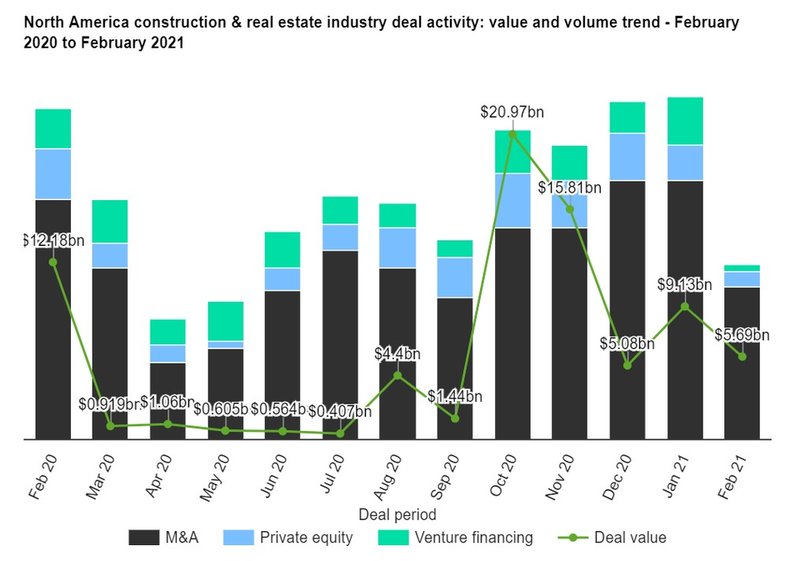

North America: deals activity down 30.43% in February 2021

North America’s construction & real estate industry saw a drop of 30.43% in deal activity during February 2021, when compared with the last 12-month average, according to GlobalData’s deals database.

A total of 48 construction & real estate industry deals worth $5.69bn were announced for the region in February 2021, against the 12-month average of 69 deals. Of all deal types, M&A saw most activity in February 2021 with 42 transactions, representing an 87.5% share for the region.

Europe: deals activity remains flat in February 2021

Europe’s construction & real estate industry saw a flat growth in deal activity during February 2021, when compared with the last 12-month average, according to GlobalData’s deals database.

A total of 62 construction & real estate industry deals worth $1.2bn were announced for the region in February 2021, against the 12-month average of 62 deals. Of all deal types, M&A saw most activity in February 2021 with 46 transactions, representing a 74.2% share for the region.

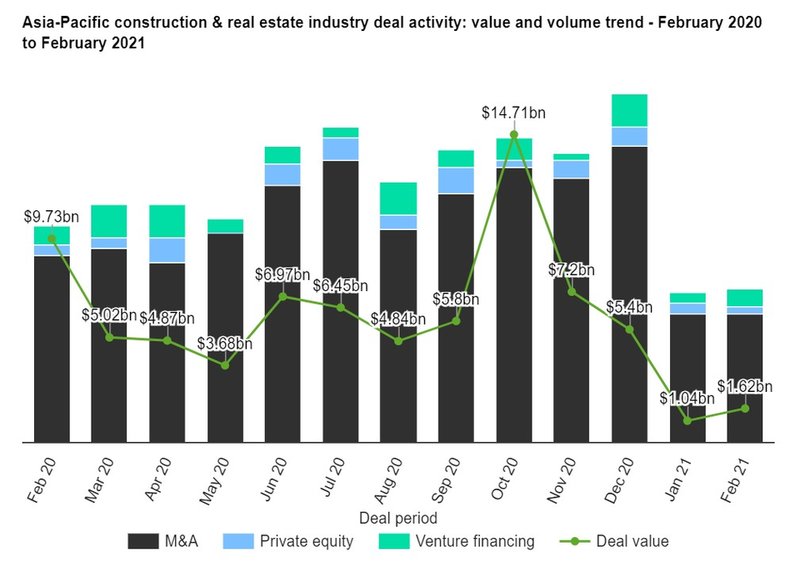

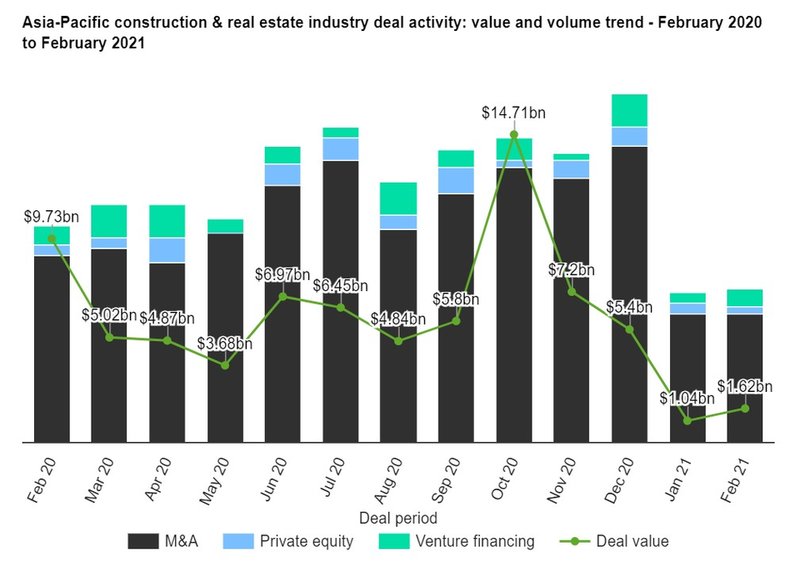

Asia-Pacific: deals activity drops 42.47% in February 2021

Asia-Pacific’s construction & real estate industry saw a drop of 42.47% in deal activity during February 2021, when compared with the last 12-month average, according to GlobalData’s deals database. The top deal was Caribbean Hero’s $989.76m acquisition of Shanghai Xinbao Enterprise Management.

A total of 42 construction & real estate industry deals worth $1.62bn were announced for the region in February 2021, against the 12-month average of 73 deals. Of all deal types, M&A saw most activity in February 2021 with 35 transactions, representing an 83.3% share for the region.