Comment

UK infrastructure budget could boost construction industry

The infrastructure spending plans outlined by the UK Chancellor in the spring budget could provide a significant boost for the construction industry, according to GlobalData.

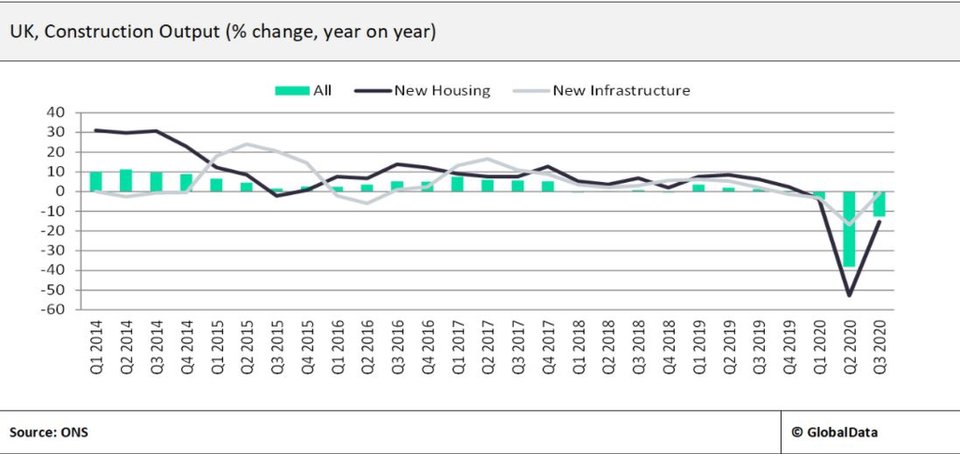

The UK economy was severely impacted by the coronavirus outbreak and the subsequent lockdown measures, with industry output falling by 13.6% in real terms last year. The construction sector was deeply affected by lockdowns and other restrictions imposed to contain the outbreak, and despite the improvement in output in Q3 and Q4 2020 on a quarter-on-quarter basis, the sector declined by 8.8% year-on-year in Q3 and 2.8% in Q4.

In its spring budget, the UK government laid out significant infrastructure spending plans which are expected to provide a boost to the industry in the short and medium term.

The plans include the creation of a new Infrastructure Bank, whose remit will be to finance and identify projects that will help the UK in reaching its net-zero emissions target. In total, the bank will have £2bn at its disposal. The bank will support growth in the infrastructure and energy and utilities construction sectors in the long term.

Chancellor Rishi Sunak also announced eight new freeports in the UK, the creation of which will provide a further boost for the infrastructure construction sector. Alongside the freeports, the government has pledged to develop an offshore wind hub at Humberside freeport, which is expected to create 3,000 jobs in the region.

UK construction output took a massive dip in 2020, as this graph from GlobalData shows.

The agreement of a new trade deal between the UK Government and the EU also bodes well for the construction industry. The trade deal ensures zero tariffs on all goods and continued market access for UK firms that trade with the EU. The trade agreement was welcomed by industries bodies, with the Federation of Master Builders stating that the industry would welcome the certainty that the deal will provide.

However, while the deal is preferable to a no-deal Brexit scenario, companies importing from the EU will face additional checks, and construction companies will also find it more difficult to hire workers from the EU due to the end of free movement of labour between the EU and UK.

Mobilising modular

GlobalData expects the infrastructure construction sector to grow by 8.7% in 2021, following a contraction of 3.8% in 2020.

The government’s spending plan will provide critical support to the construction industry as it recovers from the sharp decline in 2020. The creation of the Infrastructure Bank and the construction of eight new freeports are part of the government’s wider ‘Levelling Up’ strategy to narrow regional inequality within the UK.

GlobalData expects the infrastructure construction sector to grow by 8.7% in 2021, following a contraction of 3.8% in 2020.

The government has also outlined its exit strategy from the current lockdown measures, with all social distancing measures expected to be lifted by June 2021. The resultingincrease in economic activity, particularly in the second half of the year, will provide an added boost to investor confidence, which should help the recovery in the commercial and residential construction sectors.

Overall, GlobalData expects the UK construction industry to grow by 8% in 2021. However, in view of the widespread economic disruption caused by Covid-19, it will not be until 2023/2024 that construction output in real terms will return to pre-pandemic levels.

Main image: Bosco Verticale in Milan. Credit: Josè Maria Sava / Unsplash