DEALS ANALYSIS

Construction & real estate M&As down 23.5% year-on-year in 2020

Powered by

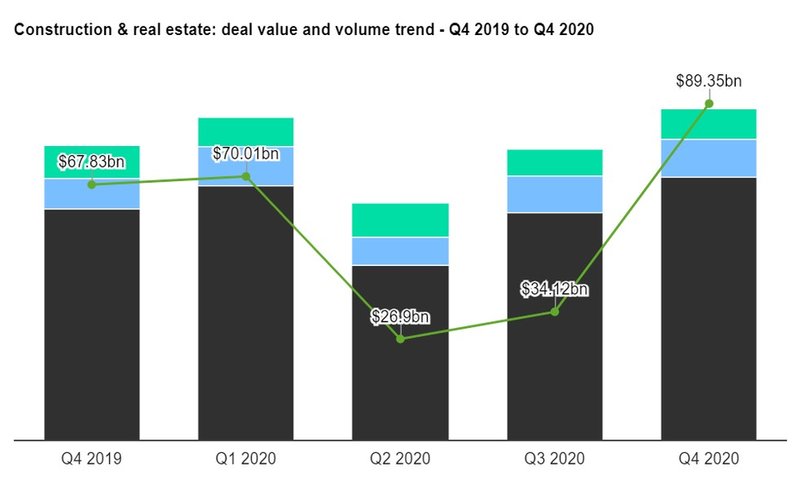

Construction & real estate industry deals in Q4 2020 total $89.35bn globally

Total construction & real estate industry deals for Q4 2020 worth $89.35bn were announced globally, according to GlobalData’s deals database.

The value marked an increase of 161.9% over the previous quarter and a rise of 79.7% when compared with the last four-quarter average of $49.72bn.

In terms of number of deals, the sector saw a rise of 15.6% over the last four-quarter average with 703 deals against the average of 608 deals.

In value terms, North America led the activity with deals worth $42.7bn.

Top five deals, as tracked by GlobalData:

- The $10.58bn merger of China Energy Engineering and China Gezhouba Group

- The $8bn acquisition of HD Supply by The Home Depot

- Samhallsbyggnadsbolaget i Norden’s $6.42bn acquisition of Entra

- The $3.8bn private equity deal with Monmouth Real Estate Investment by Blackwells Capital

- West Fraser Timber’s acquisition of Norbord for $3.38bn.

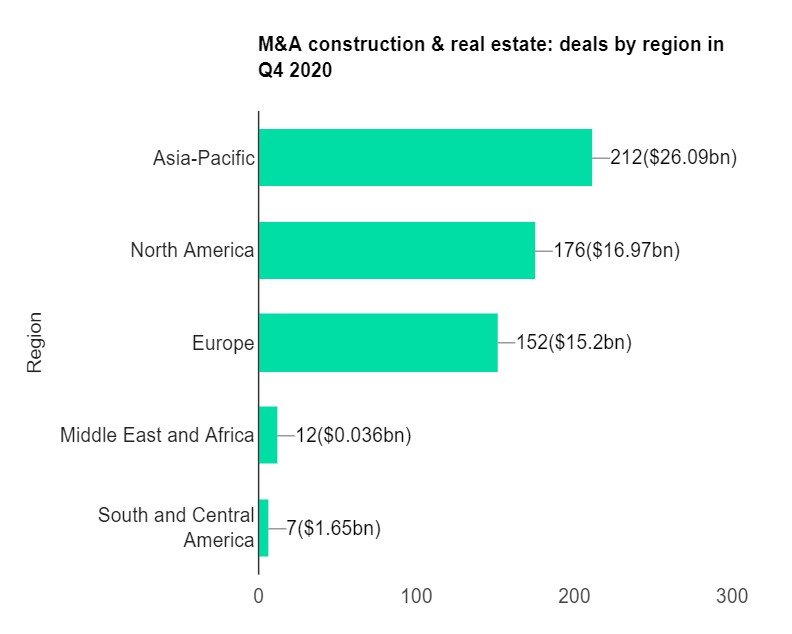

Construction & real estate M&As in Q4 2020 total $59.95bn globally

Total construction & real estate industry M&A deals in Q4 2020 worth $59.95bn were announced globally, according to GlobalData’s deals database.

The value marked an increase of 213.7% over the previous quarter and a rise of 73.9% when compared with the last four-quarter average, which stood at $34.48bn.

Comparing deals value in different regions of the globe, Asia-Pacific held the top position, with total announced deals in the period worth $26.09bn. At the country level, China topped the list in terms of deal value at $17.95bn.

In terms of volumes, Asia-Pacific emerged as the top region for construction & real estate industry M&A deals globally, followed by North America and then Europe.

The top country in terms of M&A deals activity in Q4 2020 was the US with 154 deals, followed by China with 111 and the UK with 40.

In 2020, as of the end of Q4 2020, construction & real estate M&A deals worth $143.61bn were announced globally, marking a decrease of 23.5% year on year.

Q4 deals activity by region and country

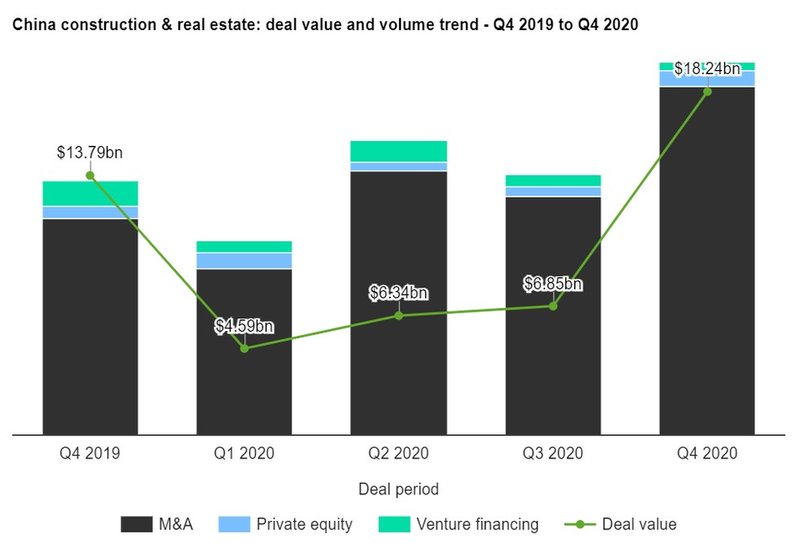

Construction and real estate deals activity in China up 48.8% in Q4 2020

China’s construction & real estate industry saw a rise of 48.8% in overall deal activity during Q4 2020, when compared with the last four-quarter average, according to GlobalData’s deals database.

A total of 119 deals worth $18.24bn were announced in Q4 2020, compared to the last four-quarter average of 80 deals. M&A was the leading category in the quarter with 111 deals which accounted for 93.3% of all deals.

In terms of value of deals, M&A was the leading deal category in China’s construction & real estate industry with total deals worth $17.95bn, while private equity and venture financing deals totalled $253.28m and $45.81m, respectively.

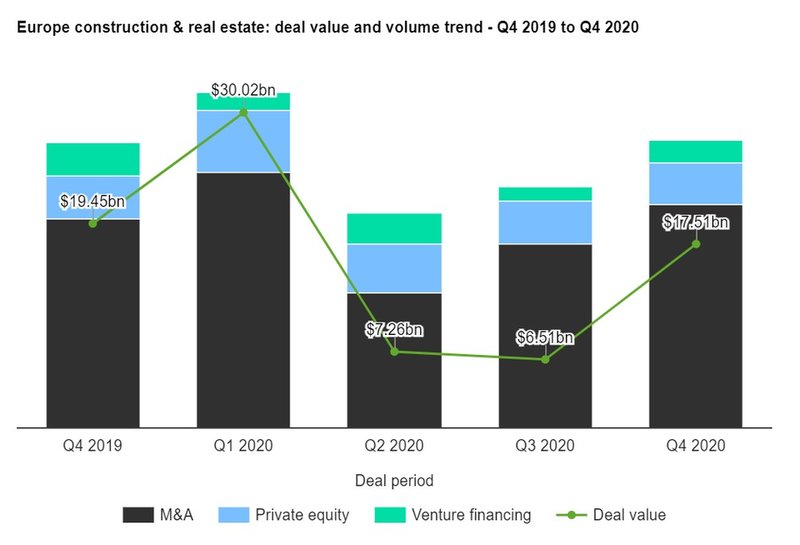

Europe deals activity up 7.1% in Q4 2020

Europe’s construction & real estate industry saw a rise of 7.1% in overall deal activity during Q4 2020, when compared to the four-quarter average, according to GlobalData’s deals database.

A total of 196 deals worth $17.51bn were announced for the region during Q4 2020, against the last four-quarter average of 183 deals.

Of all the deal types, M&A saw most activity in Q4 2020 with 152, representing a 77.6% share for the region.

In terms of value of deals, M&A was the leading category in Europe’s construction & real estate industry with $15.2bn, while private equity and venture financing deals totalled $2.14bn and $172.93m, respectively.

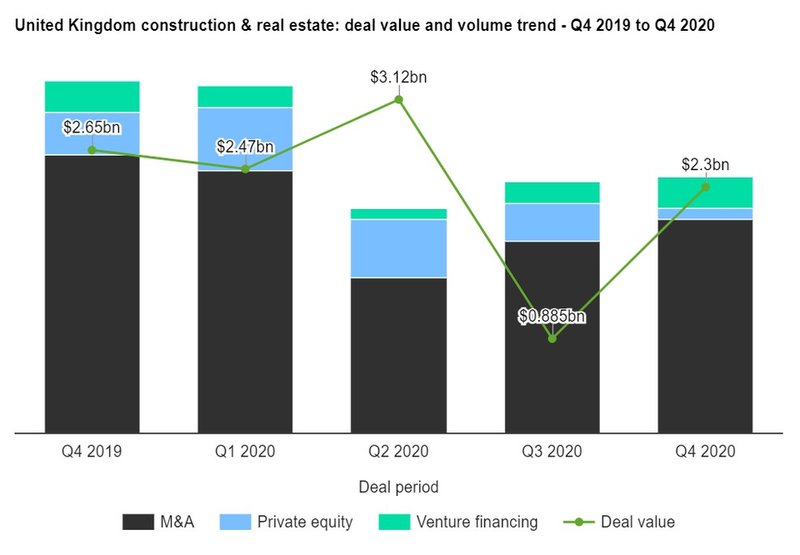

UK construction & real estate deals activity drops 12.7% in Q4 2020

The UK construction & real estate industry saw a drop of 12.7% in overall deal activity during Q4 2020, when compared with the last four-quarter average, according to GlobalData’s deals database.

A total of 48 deals worth $2.3bn were announced in Q4 2020, compared to the last four-quarter average of 55 deals.

M&A was the leading category in the quarter with 40 deals which accounted for 83.3% of all deals.

In terms of value of deals, M&A was the leading deal category in the UK construction & real estate industry with total deals worth $2.29bn, while private equity and venture financing deals totalled $9.98m and $6.57m, respectively.

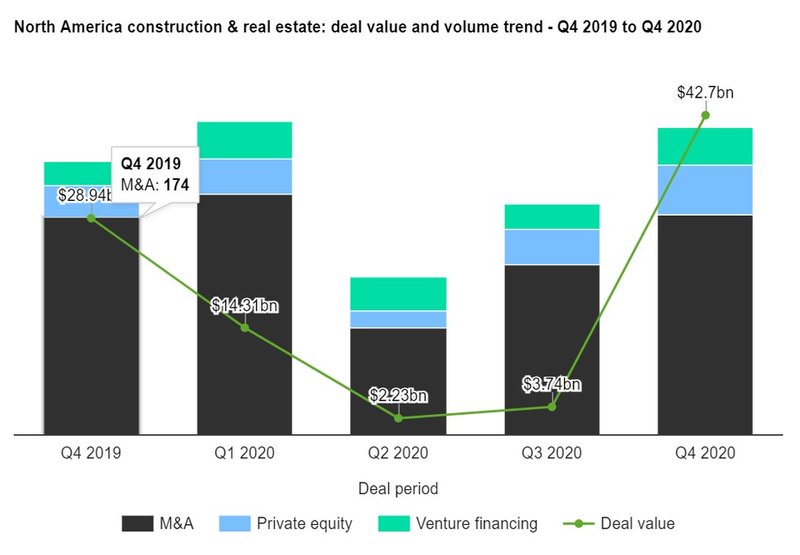

North America sees 25.5% increase in deal activity in Q4 2020

North America’s construction & real estate industry saw a rise of 25.5% in overall deal activity during Q4 2020, when compared to the four-quarter average, according to GlobalData’s deals database.

A total of 246 deals worth $42.7bn were announced for the region during Q4 2020, against the last four-quarter average of 196 deals.

Of all the deal types, M&A saw most activity in Q4 2020 with 176, representing a 71.5% share for the region.

In terms of value of deals, private equity was the leading category in North America’s construction & real estate industry with $25.56bn, while M&A and venture financing deals totalled $16.97bn and $167.31m, respectively.