DEALS ANALYSIS

Construction and real estate deals activity drops globally in Q3

Powered by

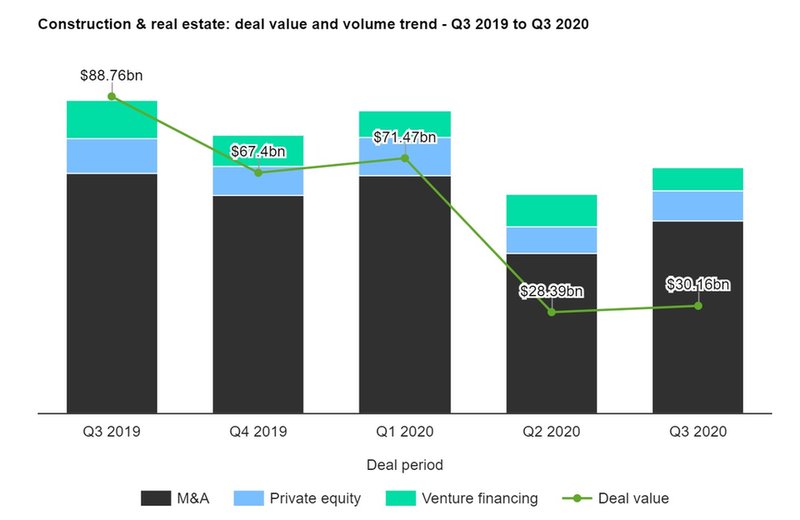

Construction & real estate industry deals in Q3 2020 total $30.16bn globally

Total construction & real estate industry deals for Q3 2020 worth $30.16bn were announced globally, according to GlobalData’s deals database.

The value marked an increase of 0.9% over the previous quarter and a drop of 52.9% when compared with the last four-quarter average of $64.04bn. In value terms, Asia-Pacific led the activity with deals worth $12.91bn.

In terms of deal volume, the sector saw a drop of 11.7% over the last four-quarter average with 551 deals against the average of 624 deals.

Top five deals, as tracked by GlobalData:

- ABCI Global Opportunities ABCI China Rising Private Equity three Segregated Portfolio, Advance Power International, CC Eagle Investments, Chan Hoi Wan, China Dragon, Elite Explorer, Golden Fortune Holding, Huatai International Greater Bay Area Investment, Image Frame Investment (HK), SCC Growth VI 2020 B, L.P, Super Brilliant Investments, Tise Opportunity Fund I, Treasure Pitcher, Well Smart Developments and YF Evergreat Property's $3.06bn private equity deal with Mangrove 3

- The $2.7bn private equity deal with Abu Dhabi Property Leasing HoldingRSC Limited by Apollo Global Management

- Builders FirstSource's $2.5bn acquisition of BMC Stock

- The $1.82bn merger of Japan Retail Fund Investment and MCUBS MidCity Investment

- Apeiron Management and Apollo Global Management's asset transaction with Grandi Lavori Fincosit for $1.49bn.

M&A deals in Q3 2020 total $20.17bn globally

Total construction & real estate industry M&A deals in Q3 2020 worth $20.17bn were announced globally, according to GlobalData’s deals database.

The value marked a decrease of 15.7% over the previous quarter and a drop of 57.2% when compared with the last four-quarter average, which stood at $47.13bn. At region level, Asia-Pacific held the top position, with total announced deals in the period worth $11.26bn. At country level, the US topped the list in terms of deal value at $4.73bn.

In terms of deal volume, Asia-Pacific was the top region for M&A deals globally, followed by North America and Europe. The top country in terms of M&A deals activity in Q3 2020 was the US with 115 deals, followed by China with 65 and the UK with 32.

As of the end of Q3 2020, construction & real estate M&A deals worth $87.7bn were announced globally, marking a decrease of 34.9% year-on-year.

Top five M&As, as tracked by GlobalData:

- Builders FirstSource's $2.5bn acquisition of BMC Stock

- The $1.82bn merger of Japan Retail Fund Investment and MCUBS MidCity Investment

- Apeiron Management and Apollo Global Management's $1.49bn asset transaction with Grandi Lavori Fincosit

- The $900m acquisition of Jernigan Capital by NexPoint Advisors

- Alibaba Group Holding's acquisition of E-House (China) for $824m.

Q3 deals activity by region and country

North America deals activity drops 18.1%

North America's construction & real estate industry saw a drop of 18.1% in overall deal activity during Q3 2020, when compared to the four-quarter average, according to GlobalData’s deals database.

A total of 172 deals worth $5.94bn were announced for the region during Q3 2020, against the last four-quarter average of 210 deals. M&A saw most activity, accounting for 74.4% of deals, followed by private equity (14.5%) and venture financing (11.05%).

In terms of value, M&A was the leading category with $5.26bn, while private equity and venture financing deals totalled $575.4m and $96.2m, respectively.

Europe deals activity drops 30%

Europe's construction & real estate industry saw a drop of 30% in overall deal activity during Q3 2020, when compared to the four-quarter average, according to GlobalData’s deals database.

A total of 138 deals worth $4.76bn were announced for the region during Q3 2020, against the last four-quarter average of 197 deals. M&A saw most activity, accounting for 75.4% of deals, followed by private equity (17.4%) and venture financing (7.3%).

In terms of value, M&A was the leading category in with $2.88bn, while private equity and venture financing deals totalled $1.69bn and $193.04m, respectively.

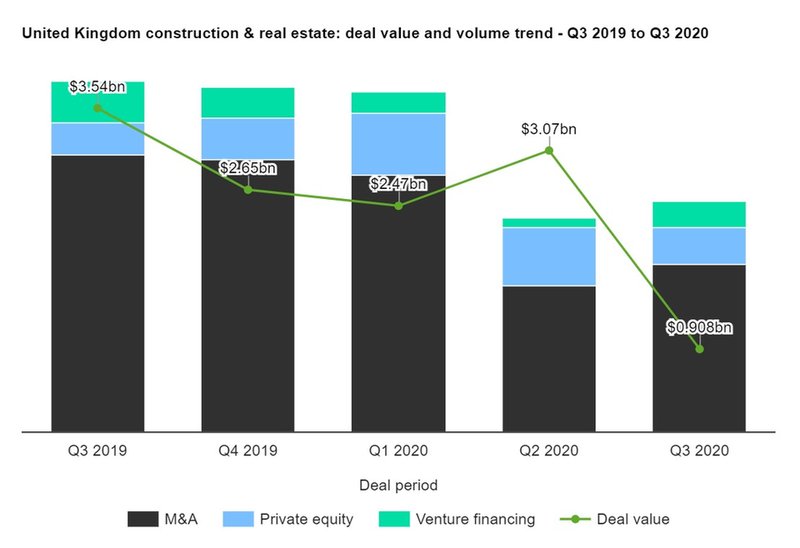

UK deals activity drops 26.7%

The UK construction & real estate industry saw a drop of 26.7% in overall deal activity during Q3 2020, when compared with the last four-quarter average, according to GlobalData’s deals database.

A total of 44 deals worth $907.79m were announced in Q3 2020, compared to the last four-quarter average of 60 deals. M&As accounted for 72.7% of deals, followed by private equity (15.9%) and venture financing (11.4%).

In terms of deal value, M&A was the leading category with total deals worth $548.59m, while private equity and venture financing deals totalled $182.67m and $176.53m, respectively.

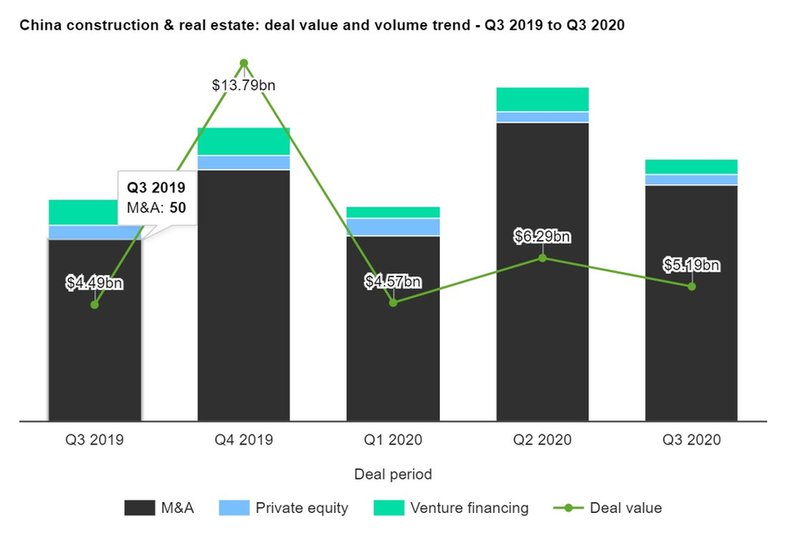

China deals activity drops 1.4%

China's construction & real estate industry saw a drop of 1.4% in overall deal activity during Q3 2020, when compared with the last four-quarter average, according to GlobalData’s deals database.

A total of 72 deals worth $5.19bn were announced in Q3 2020, compared to the last four-quarter average of 73 deals. M&A was the leading category, accounting for 90.3% of all deals, followed by private equity (5.6%) and venture financing (4.2%).

In terms of value, M&A was the leading deal category in China with total deals worth $4.67bn, while private equity and venture financing deals totalled $503.2m and $16.21m, respectively.

Latest deals in brief

BAE Systems and Meggitt sign deal for Typhoon radar equipment

BAE Systems has awarded Meggitt a £4.2m contract to supply nose radome technology for the Eurofighter Typhoon’s Multi-Function Array radar system. BAE Systems is working with Leonardo to equip some UK Typhoons with the new European Common Radar Systems Mk 2 (ECRS Mk 2), which gives the fighters the ability to locate, identify and suppress adversaries air defences. The radome developed by Meggitt protects instrumentation from environmental effects and prevents electromagnetic interference with the equipment.

Kongsberg and Pratt & Whitney sign contract for F-35 engine maintenance facility

Kongsberg Aviation Maintenance Services has signed a contract with Pratt & Whitney to open F-35 fighter aircraft engine maintenance facility at Norway. The site at Rygge will be one of five maintenance, repair, overhaul and upgrade facilities to be developed worldwide to enhance maintenance capabilities of the F135 engine that powers the F-35 aircraft. The contract covers the transition of the Kongsberg facility from activation and training to qualification and operations in order to achieve initial depot capability by the end of next year.

BAE Systems and University of Birmingham partner for advanced sensing technologies

BAE Systems has signed a partnership agreement with the University of Birmingham for the development of advanced sensing technologies. The resulting Advanced Sensing Technologies Consortium is part of the National Quantum Technologies programme, which is funded by the UK Government and seeks to support four technology hubs based in the UK.

Danish Defence and Fleet Complete partner to improve vehicle access

Danish Defence has partnered with global provider Fleet Complete to use its fleet management and carsharing solution. As part of this collaboration, 2,000 Danish Defence vehicles have been subscribed for the solution. The mobile reservation and carsharing app will improve access to vehicles for all defence staff members around the country. This will also allow assets to be used to conduct operations in a more economical and environmentally responsible manner.